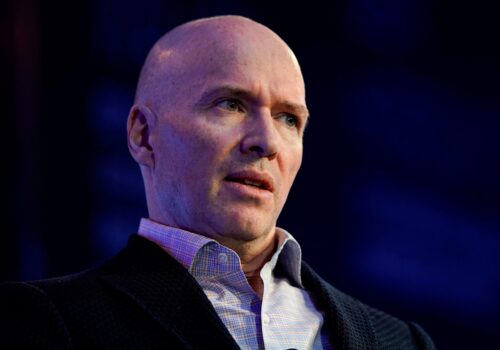

Venture capital firm Andreessen Horowitz is seeking to raise about $20 billion in what will be the largest fund in its history, to capitalize on global investors’ interest in backing U.S. artificial intelligence companies, sources told Reuters.

The tech investment firm, known informally as a16z, has told limited partners that the fund will be dedicated to growth-stage investments in AI companies and draw upon global investors keen on investing in American companies, the sources said.

Why it matters

Even by the standards of a firm known for raising some of Silicon Valley’s largest investment vehicles, the new fund would represent a colossal step up in scale. It would test LPs’ interest in venture capital amid global economic turmoil and continue the debate over how scalable this asset class is while maintaining appealing returns. If successfully raised, the new megafund would be surpassed only by SoftBank’s 9984.T two Vision funds, a massive experiment by deploying unprecedented amounts of capital into the tech sector, which has yielded mixed results.